When planning digital campaigns, perhaps the most important decision criterion when executing them is return on investment (ROI). In this blog, we will teach you the formula for calculating ROI and the advantages of using it.

When we talk about ROI, we are referring to the return on investment in any project or campaign we undertake. In other words, ROI is an indicator that allows us to identify whether or not an investment is profitable. There is a generic ROI formula for calculating return on investment, which is as follows:

For example, if we have a brand that invests $100,000 in a campaign to increase sales and achieves revenue of $300,000, its ROI would be three times the initial investment. However, if you want to represent this as a percentage, you would have to multiply it by 100%.

This would be the result in a simple and illustrative way.

To begin with, we need to put ourselves in context. We need to identify concepts or terms such as CPA, LIFETIME, TICKET, among other indicators that help us obtain the cost and revenue per customer acquired.

The first term we need to consider is CPA. CPA is the cost of acquisition, which is the investment we make to get a customer. If you have already run campaigns and have historical data, to obtain this value you must divide the total investment by the number of customers acquired. But if you have never run a campaign and this will be your first time, you can forecast this value. To do so, I invite you to read the following article:

What is CPA and how can you forecast its results in SEM or SMM advertising campaigns?

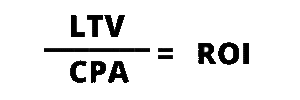

If we already have the CPA, we have the denominator of the formula for calculating ROI. In the numerator, we must calculate the lifetime value of a customer, which represents the potential revenue generated by a new customer. Lifetime value (LTV) is the result of multiplying the customer’s lifetime or repurchase frequency by the ticket or average purchase value.

![]()

Once we have indicators such as LTV and CPA, we can accurately forecast our ROI.

As in the example above, we divide the LTV indicator by the CPA to obtain our ROI indicator.

Through our operation, with the results obtained, we can decide whether our strategy is successful, whether we can optimize it to increase ROI, or whether we should definitely change it.

ROI is forecast using values that have been presented in the organization, so the results will be adjusted to reality and give you a better overview to make the right decision.

If you found the information in this article useful, share it so that others with the same concerns can find solutions to their business needs.